A SAGE Negro economist once said, "We've boiled it down to this — if your outgo exceeds your in-come, your upkeep will be your downfall."

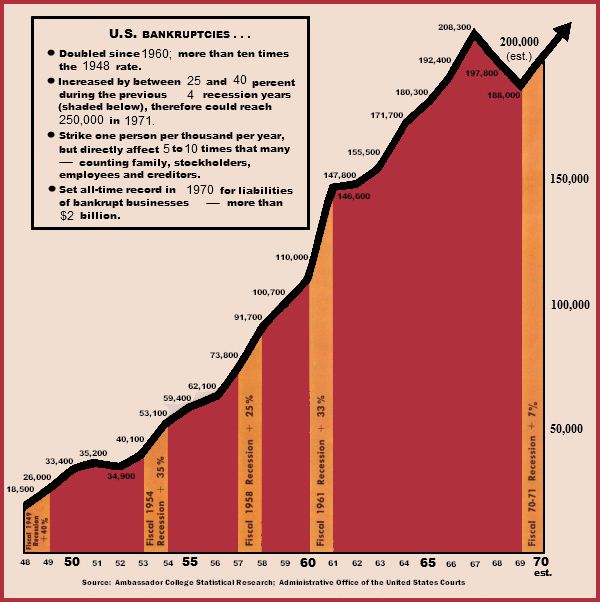

We couldn't have said it better! Bankruptcy strikes over 200,000 individuals and corporations yearly in the wealthiest of all nations — the United States. Bankruptcy is as "American as cherry pie." Here's the rundown:

|

PERSONAL: Over 178,000 American individuals — a record — filed for bankruptcy in 1970. What happened to these hapless individuals? Most merely filed the appropriate forms, then went right on living and working as usual. The bankruptcy court handled their paycheck and debts until the two balanced. Last year's bankruptcies ranged from $65-a-week welfare cases all the way up to the heir of the DuPont fortune, who listed assets at a mere $26 million, and debts at $63 million!

BUSINESS: A record 10,750 businesses failed in 1970, over one fourth of them owing debts of over $100,000. Combined debts of these companies totaled a record $2 billion, not even counting multibillion dollar Penn Central, the world's largest transportation company. As in personal bankruptcies, businesses may continue service, while court-appointed managers straighten the books, under so-called "Chapter 11" proceedings.

|

STATE and LOCAL GOVERNMENTS are virtually on the brink of bankruptcy, due largely to multiplying welfare loads. If such a governmental failure finally occurred, you could count on a superior power, "the lender of last resort," the Federal Government, to attempt to balance their books.

NATIONAL and INTERNATIONAL: What if a nation goes bankrupt? Impossible, say most economists, since a national debt is mostly "internal" — for instance, Americans owing other Americans two trillion dollars. Only the "external" debt of some $50 billion balance of payments deficit is worrisome.

But wait! To back up such "external" liabilities, the United States has only about $11 billion in gold and $3 billion in foreign currencies, Special Drawing Rights, and other financial assets accepted by foreigners.

Is the United States then "externally" bankrupt? Yes! The only difference is that the "collection agency," or court-appointed referee has virtually no power to collect. The debtor (the U.S.) is presently stronger than the creditor — mainly Europe.

But could it be that the $75 billion in the annual U.S. direct investments abroad (or, more vitally, the $170 billion in United States assets abroad) could be rightfully "nationalized" (confiscated by Europeans) as payment for America's 50 billion in external debts? The Europeans are especially upset at the "dollar glut," and the U.S. pursuing a policy of "benign neglect" toward its chronic balance of payments deficit. Could "bankruptcy proceedings" against the United States be Europe's only answer?