THE ERODING DOLLAR

|

In the past thirty years the American dollar has dwindled by almost two thirds. This means that $100 put in a safe deposit box in 1939 will now buy only $38 worth of goods and services.

A married man with two children had to earn $14,440 in 1968 to buy what just $5,000 bought a man in his position thirty years ago. That is 188.8% more — just to stand still!

Now look at what has happened in just the last decade. One hundred dollars in cash put away as recently as 1958 will now buy only $79 worth of the essentials of life.

View the problem in another way. You were a man earning $7,500 in 1958. Today you earn $12,000 a year and have a wife, two teenagers and a home in the suburbs. How much more actual spending money will you have?

|

|

|

The Tax Foundation figures you have a mere $1,954 left after taxes and inflation. And basically the same problem has afflicted the British public the past several years. Inflation and a crushing tax load have robbed many laborers in Britain of the incentive to work harder or put in extra hours on the job.

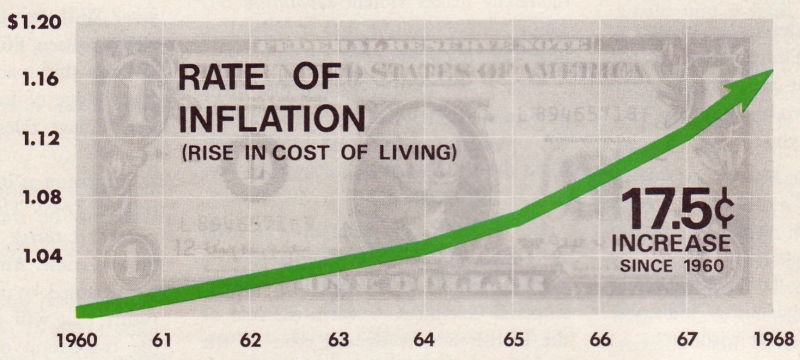

Living costs as measured by the .U.S. Government's Official Consumer Price Index have gone up every year for the past decade. From 1960 through 1964, the average annual increase was about 1.2 percent — "just a little inflation." But when the U.S. began to send large numbers of troops to Vietnam in 1965, inflation accelerated rapidly. The increase in the price index was 1.7 percent in 1965, 2.9 percent in 1966, 2.8 percent in 1967, and 4.2 percent in 1968.

This year it has spurted upward alarmingly at an annual rate of 7.5 percent! A dollar received as late as January is worth only 96 cents today, and if the present rate continues, it will shrink to about 92 cents in value by the year's end!

|

The U.S. is plagued with spiraling inflation.

Americans and Britons find it increasingly difficult to make ends meet.

Why?

How can you, personally, best cope with the rising cost of almost everything?

INFLATION is, after Vietnam, the U.S. Government's biggest worry. For years this insidious economic disease had been virtually unnoticed. It quietly — but steadily — ate away, little by little, at the vitals of American economic strength.

Now the pace of inflation has abruptly accelerated! Almost overnight, it seems, it has turned into an economic cancer.

So serious has inflation become that leaders in government and business are now calling it the number one domestic and political issue of the country — a problem more serious than civil rights, crime, campus unrest.

Economist Turns Prophet

In a rousing speech in Copenhagen, Denmark, the Chairman of the U.S. Federal Reserve System, William McChesney Martin, Jr., shocked his audience. It is more important to the world, he said, for America to solve its mushrooming problem of inflation than to settle the war in Vietnam.

Martin called for a return to the basic economic principles of supply and demand, sound credit and limitation of debt.

"I'm not here to predict collapse and decline. . . But if we throw these principles to the wind, there is no gadgetry in monetary mechanisms and no device that will save us from our sins," concluded Martin.

He predicted: "We're going to have a good deal of pain and suffering before we can solve these things."

But not even Chairman Martin envisions just how much pain and suffering our peoples might have to go through in order to learn our lesson.

Inflation: Disguised Theft

Inflation is nothing less than disguised theft — and we once believed that it was wrong to steal. But gradually, as the nation began to accept the foolish philosophy that there are no absolutes — no eternal truths — people began to think that under certain circumstances it is all right to steal "just a little."

On the national level, some influential "growth-happy" economists and political leaders have propounded that inflation is all right — so long as it was "just a little."

As international economic consultant S.J. Rundt so aptly puts it: "What used to be heresy to all Americans is now increasingly taken for Gospel truth by many or even most, namely that one can comfortably live with a little inflation, that annual price rises of 1%-1.5% serve a dynamic society."

Now the United States is heading into deep economic trouble both at home and abroad. National leaders are beginning to see the error of this "New Economics" philosophy.

Inflation exacts a terrible penalty, both nationally and individually. Inflation distorts the entire economy. One news magazine stated it bluntly: "Inflation is to the economy what pollution is to the environment — a corrosive force that unbalances everything."

And leading investment analyst, Dr. Pierre A. Rinfret, said in The Institutional Investor: "I feel passionate about inflation. I abhor it, I detest it, and I fear it. It guts the very fabric of freedom and turns topsy-turvy all the things that made this country great."

According to Mr. Rundt, if the purchasing power of money erodes by 1 percent a year, it takes 70 years for prices to double. But at 2.5 percent per year, a man starting to work at 18 sees prices double by the time he is 46.

And at the rate of 5.4 percent, at which the U.S. economy was clipping along early this year, a person who begins working at 18 will find that prices have doubled before he is 31. They will have doubled again before his 44th birthday, and redoubled at 57 when he begins to think of his retirement.

Mr. Rundt concludes by asking: "Is that not theft from what a man earns by the sweat of his brow and from savings he manages to put aside for his advanced years?"

It certainly is!

Inflation hurts everybody — but some are hurt more than others. "The impact falls most notoriously on those who have the most meager means to withstand it — the poor, the black and the aged. It cheats the thrifty, taking money from every owner of a U.S. savings bond and every depositor in a savings account" (TIME, June 20, 1969).

The Deadly "Psychology of Inflation"

For those on low fixed incomes, inflation can be a personal tragedy. For those who have a means of increasing their income, inflation creates a vicious cycle that feeds on human greed and lust. It destroys moral and spiritual character.

This grasping, selfish attitude of "out-grabbing" the other fellow, getting now before prices rise still further is politely called the "psychology of inflation." It appeals to human nature. And once this attitude gets a grip on a nation, that nation is in deep trouble.

As an example of the vicious circle of inflation, the gross pay of construction industry workers in New York City jumped from $170.69 weekly in 1965 to $201.12 weekly in 1968 — an increase of $30.43 a week. But the real net gain after inflation and higher taxes? $1.36 per week!

So in this dog-eat-dog world the union worker all too often tries to get more from his employer (without necessarily producing more) and to get it faster than the government will get more from him in taxes. The producers of goods and services he needs will soon get more from him by upping their prices!

In order to keep ahead of the game, some unions are now talking of annual contracts. If they sign a two or three year contract they fear that inflation will increase so much that their workers will come out on the short end.

The longer this upward inflationary spiral continues, the more vicious it becomes.

The dilemma in coping with inflation is the psychology of inflation. Inflation psychology feeds on itself. Labor demands higher wages because it anticipates higher prices. Management raises prices and capital expenditures because it anticipates higher costs. The investing public turns to speculation.

As inflationary expectations turn to reality, inflation takes on a snowballing effect. Once inflation reaches this point, the entire nation is in danger.

Four Penalties of Inflation

What happens to a nation when it becomes locked in an inflationary spiral? Answers Dr. Pierre A. Rinfret (whom we quoted earlier), "It is a country without savings to speak of. That means that everything is dedicated to the present and nothing to the future. Live today, because tomorrow it will cost more."

"If there are little or no savings," explains Dr. Rinfret, "there are no housing loans, and consequently little housing construction."

The first penalty of inflation therefore is a drop in housing construction.

The second penalty that inflation brings is the destruction of long-term lending for business purposes. The economy becomes unable to make the investments that ultimately maintain its position in the industrial world.

The third major penalty of inflation is the fostering and abetting of dishonesty. "It fosters, condones, necessitates and rewards dishonesty," says Dr. Rinfret. "Faced with inflation, people grasp for ways to avoid the deterioration in their purchasing power."

We would add that inflation produces a fourth result: It causes a nation to lose out in world trade. Here, for example, are two instances of the effect inflation is having on U.S. foreign trade:

" 'Rampant inflation' in the United States is making it increasingly difficult for Caterpillar Tractor Co. and other domestic companies to sell their products abroad.

"Caterpillar President William H. Franklin said here today that his company, which is the nation's largest exporter of machinery, is finding it increasingly difficult to compete, say, in Brazil, with Italy's Fiat, which enjoys lower labor and material costs.

"In 1969, construction equipment prices rose some 5 percent in the United States" (Donald E.L. Johnson, Journal of Commerce, Feb. 19, 1969).

Japan's largest stock brokerage house, Homura, recently told Japanese businessmen the outlook is rosy for Japanese exports. Because of continuing inflation, it said, "The United States is losing its ability to compete in the world market."