Taxes, Taxes and More Taxes

By modern standards, ordinary taxes in the Roman Empire were low throughout the second century (A.D.). But in the third century, to meet rising military expenses, the demands of the soldiers, and the extravagances of the emperors, there were frequent confiscations of property and periodic exactions from the wealthy class.

"The most disastrous policy in its immediate effects was extravagant spending by the government of the Empire. Part of the money went into the magnificence of the cities, part into the maintenance of the army and of the vast bureaucracy required by a centralized government. Gradually the soldiers and the civil servants became dominating pressure groups.

"The expense they entailed led to strangling taxation with repeated devaluations of the currency that fatally weakened the middle class and decimated its natural leaders. . . Disintegration followed the stifling of initiative" (Haskel, The New Deal in Old Rome, pages 231, 232).

That was Rome.

Every American and Briton is more than well aware of the voracious tax bite which gobbles up a bigger chunk of his income with each passing year.

Latest statistics reveal that all U.S. taxes combined — federal, state and local — consume a phenomenal 37 cents out of every dollar of national income.

Much tax money goes to support the vast bureaucracy of government on all levels. Nearly one job in five is a government job. More than $1 in every five spent in the entire U.S., for all goods and services, is a government dollar.

Federal government income and spending increase every year. In the six years of the Johnson administration, total annual spending rose by $73,000,000,000 — from $111,000,000,000 to over $189,000,000,000.

Yet income never seems to match the outgo. There have been only eight balanced federal cash budgets in the past 40 years!

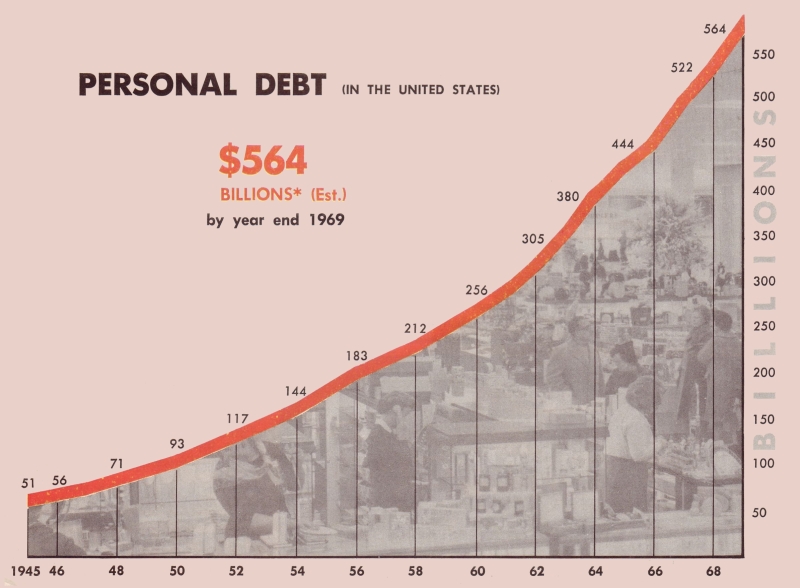

• Personal debt has grown 1000% in 24 years and increases more than $1,000 a second!

• Has doubled since 1961.

• The average family of 4 owes $11,000 in personal debt.

• Banks own 70% of all cars!

|

States Scramble for Money

State and municipal taxes are rising astronomically, too.

All indications are that 1969 will go down as the biggest in history for the adoption of new and increased taxes at the state level.

Cities are finding themselves at the end of the rope on taxation. With the exodus of the white-collar middle class to the suburbs, city tax bases are crumbling. Yet city and county employees across the country — notably police, firemen, sanitation workers, hospital employees — are demanding costly new wage contracts.

Little wonder that there are growing signs of a tax revolt in parts of the United States. More and more local bond issues are being turned down by irate voters. School districts have to pare budgets as a result. High schools in Los Angeles, for example, have been forced to curtail inter-scholastic athletics as a result of a bond issue rejection.

In 1902, the total bill for taxes of all kinds in the U.S. amounted to $18 per capita. By 1948, it had risen to $377; by 1960, $709. In 1968 it was more than $1,000. This year should see another rise.

British Stop Fighting It

Tax-weary Britons are almost resigned to harsh austerity budgets every time there is a panicky run on sterling.

In what some termed the harshest budget in British peace-time history, the government in early 1968 imposed staggering tax hikes. It also put a temporary ceiling on wages and invoked a "soak the rich tax" the likes of which were previously unknown. Some recipients of investment income over a certain level actually found their entire earnings from stocks completely taxed away!

Taxes are so severe now that the principle of "live today, forget tomorrow" has gripped the British public. Stores report a buying spree for cars, refrigerators, clothes, carpets — everything. Crowds at soccer matches are the biggest and rowdiest in 20 years. Betting shops and bingo halls have more customers than room for them.

"People have no reason to save their money," says a secretary in London. "If you keep it the government will soon find some way of taking it from you."

Tax Evasion and "Loopholes"

When taxes get nearly unbearable the temptation to evade them becomes great.

"A volume might be written on the subject of financial corruption in the last century of the Western Empire. When one wanders through the maze of enactments dealing with fiscal oppression . . . and evasion, one knows not whether more to pity the weakness of the government, or to wonder at the hardened . . . audacity of the classes which were leagued together in plundering both the treasury and the taxpayer.

"In the early part of the fifth century, the province of Africa, so essential to the very existence of the capital, yet held by so precarious a tenure, appealed . . . to the Emperor for relief from its miseries. The complaints relate almost entirely to oppression and injustice in the collection of the various branches of the revenue. The upper classes secured immunity from their proper burdens, or succeeded by unfair assessment in shifting them on to the class less able to bear them. . .

"Alike in Africa and Gaul, the great landowners at this time, taking advantage of the evident weakness and difficulties of the government, either evaded or delayed their payments" (Dill, Roman Society in the Last Century of the Empire, pages 270-271).

How similar conditions have become in the U.S. and Great Britain today.

Recently, there was the shocking revelation that — thanks to giant-sized legal loopholes — some American millionaires paid no income tax at all in 1967. Additional scores of individuals with incomes in six figures also paid nothing.

It has been estimated that $50,000,000,000 in possible tax revenue slips through the federal government's grasp because of leaks in the tax structure.

The biggest loopholes, of course, benefit the wealthy. Congress is finally beginning to constrict a few of the more gaping holes.

In Britain, tax evasion — whether legally or illegally — has become a virtual sport.

The British Empire, explains historian Einzig, quoted earlier, was built up and maintained by the devotion of the people to the cause of their country. Now that devotion seems to have almost vanished. The "every man for himself" attitude predominates. Says Einzig:

"While before and during the War British people were probably the most public-spirited people in the world, today they probably rank among the least public-spirited. One of the manifestations of this change in the attitude of the British people has been the increase in the degree of tax-avoidance and tax-evasion.

"Britons have become much more reluctant to render unto Caesar what is Caesar's. Admittedly this is largely Caesar's own fault. . . Taxpayers have become increasingly reluctant to surrender an increasingly large proportion of their incomes to governments which are so keen on wasting their money.

"Many thousands of accountants and solicitors are busy advising their clients how to avoid their taxes lawfully. But many millions of the lower income groups, too, have found ways, even without receiving professional advice, for evading their taxes unlawfully. . . Nothing is ever said about all this, yet the sum total of all such loss of revenue must surely exceed that of the total losses through evasion by the rich" (Einzig, Decline and Fall, pages 29-30).

The Welfare State

Most people have heard of the "bread and circuses" of Rome — the doling out of free food and the endless series of bloody games and contests, intended to keep a restless population under control.

"Welfare (itis)" was a disease which sapped Rome's vitality.

"The free distribution of corn at Rome has been characterized as the 'leading fact of Roman life.' . . . Just before the establishment of the empire, over three hundred thousand Roman citizens were recipients of this state bounty. In the time of the Antonines (around 150 A.D.) the number is asserted to have been even larger. . . In the third century, to the largesse’s of corn were added doles of oil, wine, and pork.

"The evils that resulted from this misdirected state charity can hardly be overstated. Idleness and all its accompanying vices were fostered to such a degree that we probably shall not be wrong in enumerating the practice as one of the chief causes of the demoralization of society at Rome under the emperors" (Myers, Rome: Its Rise and Fall, page 523).

The same disease has progressed to advanced stages in Britain and America today. Britain already has a Scandinavian-style "womb-to-tomb" welfare state. Its excesses are such that they have even fostered one of the most famous contemporary comic strips throughout the English-speaking world — a ne'er-do-well flop of a husband called "Andy Capp."

In the United States the welfare load is almost beyond the power of cities and large states to handle. Here are some of the staggering statistics:

• In the states of California and New York live 2¼ million people on relief — 1 out of every 4 welfare recipients in the country.

• One million people are on welfare in New York City — one out of every eight people in the city.

• In the past prosperous decade, nearly 3 million Americans have been added to the dole, so that today 10 million people receive welfare of some form.

• Nearly 6 million Americans subsist on free surplus food allotments or cut-rate food stamps.

• The biggest headache of all is aid to families with dependent children, which has grown phenomenally in the last few years.

Daniel Patrick Moynihan, head of the Council on Urban Affairs, reports that the heart of the problem is dependent children from broken families. "The poor of the United States," he says, "today enjoy a quite unprecedented de facto freedom to abandon their children in the certain knowledge that society will care for them."

The looming crisis over welfare is what prompted President Nixon to propose a revolutionary overhaul of the entire welfare program. In a speech on nationwide television, he assailed the existing hodge-podge of state-administered programs as a "colossal failure" that "breaks up homes" and often penalizes those who work.

The new proposals are intended to "reward work" and encourage families to stay together. But the initial cost of implementing the new program, if approved by Congress, will be expensive. It will add $4,000,000,000 to federal government costs in the first full year of operation.

And under the new plan the welfare roles, which now total 10 million people, would increase to more than 22 million. Thus, about 11% of the U.S. population would qualify for some welfare assistance.

Welfare, once begun, becomes a virtual "state within a state" proposition; difficult to reform, nearly impossible to reduce in scope and cost.

Rome Grew Big — Then Fell

Rome grew big, powerful and prosperous. Then in gradually deteriorating stages that perhaps few in that day detected, she became indolent, sick and pitifully weak, unable even to defend herself against the rampaging attacks of her enemies.

Rome's power and prosperity didn't insure her lasting success.

Neither can a purposeless, aimless America or Britain — devoted solely, it seems, to the "good life" and "getting it now" — insure its future in peace and security. The U.S. and Britain have grown BIG — when will we fall?

Rome had other flaws in her national character too. We'll describe the next fatal flaw in Part III of this series next month. Meanwhile, if you are experiencing financial difficulties, why not write for our free reprint article, "Will You Ever Get Out of Debt?" It contains much helpful information on the subject of family finances.